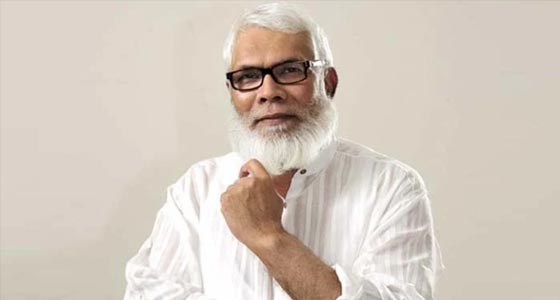

News analysis : Salman F Rahman was ‘mafia ‘ in economic sector

- Last Update : 05:22:24 am, Saturday, 24 August 2024

- / 869 Read Count

Hemayet Hossain

When talking about scams and manipulations in the stock market and banking sector, the name that comes to everyone’s mind is Salman F Rahman. In the 31 years since 1993, there is no such scandal in the stock market, where Salman F Rahman’s involvement is not found. He invented new methods of manipulation.

He has always remained out of touch by abusing state power. Among them, in 2006, a fake person named Prince of Saudi Arabia staged a drama to buy silver banks. In this process Rupali grabbed 900 crore taka from the bank’s shares. In the last three years, he has taken Tk 6,600 crore visible from the stock market. Out of this, Beximco took 3000 crores from Sukuk Bonds, 1000 crores from IFIC Amar Bond and 20600 crores from Beximco Zero Coupon Bonds. However, this figure will exceed Tk 20 thousand crores in 3 years with invisible and unanimous combined.

In 1996, he was involved in Shinepukur Ceramics and Dohar Securities scandals. He is still a defendant in that case. The case is pending in the High Court. In 2011, Khondkar Ibrahim Khaled’s investigation report on stock market manipulation also came under his name. At that time, he passed the preference shares of Beximco Pharma. Through this share he collected 410 crore rupees including premium.

At the same time Shinepukur collected Tk 286 crore through Ceramics and Beximco Textiles collected Tk 635 crore.

Besides, he sold the placement shares of GMG Airlines and took Tk 300 crores. The company later disappeared. But the investors did not return the money.

Similarly, he took a loan of Tk 228 crore from Sonali Bank in the name of GMG Airlines. In this case, Salman F Rahman’s Dhanmondi house was mortgaged. Sonali Bank calls for auction of his house if he does not pay later. In 2013, he bought a share of 10 rupees for 75 rupees in Nepal’s loss-making company with the money of IFIC Bank. In this process, 125 crore rupees were smuggled there. In 2011, he collected Tk 1000 crore from the stock market through IFIC mutual fund through fake documents.

Beximco Group Vice Chairman Salman F Rahman was Awami League president and former Prime Minister Sheikh Hasina’s private sector advisor. He is also the former president of Federation of Bangladesh Chamber of Commerce and Industry (FBCCI). In the 2018 and 2024 National Parliament elections, Salman F. Rahman was elected from Dhaka-1 constituency and became a Member of Parliament from the Awami League. In both the elections, he was elected Member of Parliament by capturing the polling stations through various hellish activities including massive vote rigging, center occupation, terrorism, attacks on journalists. He is also accused of looting government money in the name of development in Nawabganj-Dohar area.

Apart from this, there are allegations against Salman of taking over the bank, looting money from the bank depositors in the name of loan, taking illegal benefits from the bank by spreading political influence, money laundering from the country, defaulting without paying the bank loan. Not only that, he also committed serious financial irregularities like renewing 17 defaulted loans.

Besides, although he was not a member of the cabinet, he had great influence at all levels of government. After the Awami League government came to power in 2009, Salman F Rahman took control of IFIC Bank. He has been in control of the bank since then. He has looted a large amount of money from the bank during the discussion. It is to be noted that before 2009, he was removed from the post of director of IFIC Bank due to various irregularities and corruption allegations.

Sayan Fazlur Rahman, son of Salman F Rahman, lost the directorship of IFIC Bank: Sayan Fazlur Rahman, son of Salman F Rahman, lost the directorship of IFIC Bank due to default. Bangladesh Bank has issued this instruction in a letter sent to the Managing Director of IFIC Bank on August 11.

According to the letter, the central bank did not re-appoint him as a director due to the default of loans taken from Syan IFIC Bank in the name of Aces Fashions Limited. Earlier on June 27, IFIC Bank’s 47th Annual General Meeting requested Sayan’s re-appointment by the bank’s board of directors. According to section 15 of the Bank Companies Act, 1991, the central bank rejected the application. Sayan’s father Salman F Rahman is currently the Chairman of IFIC Bank.

Illegally took Tk 22 thousand crores from Janata Bank: Meanwhile, Beximco Group took a loan of Tk 21 thousand 978 crores from the state-owned Janata Bank in violation of the rules.

According to Bangladesh Bank’s inspection report, Janata Bank has given loans of around 22 thousand crore rupees to various institutions of Beximco Group without following the proper rules of the central bank. According to the calculation, through this they have given loan facility of 949.78 percent of the bank’s capital to only one group.

There is no rule to lend more than 25 percent of the capital (funded and non-funded) to any single customer. Despite several letters from the central bank asking for information on the overall debt of the Beximco Group, the bank did not comply with it. Rather, the information has been kept secret from the central bank. After that, Beximco applied for a new loan of Tk 479 crore 36 lakh. Based on this, the matter came into discussion. Because it is not possible for the bank to take such a big decision. So Janata Bank applied for Central Bank’s permission.

According to the inspection report of Bangladesh Bank, on July 25, the 778th board meeting of Janata Bank has established 26 companies of Beximco Group.

No concerned person was available to make comments on behalf of Beximco Group over the above allegations.